Table of contents

In this guide, we will explore one of the key leaders integral to a businessŌĆÖs overall success: the chief financial officer.

What is a chief financial officer?

In recent years, companies have made many new additions to the C-suite, but there will always be a few senior leaders who remain staple players in an organizationŌĆÖs rung of strategic advisors. In this guide, we will explore one of those key leaders integral to a businessŌĆÖs overall success: the chief financial officer.

A chief financial officer (CFO) is the highest-ranking financial professional within an organizationŌĆÖs common corporate hierarchy, and is brought on board to optimize the financial performance of a company. This corporate officer oversees all financial and accounting functions and teams within an organization and provides necessary operational and budgetary support. Reporting directly to the chief executive officer, the CFO works closely with the CEO to mitigate risk, obtain funding and forecast the financial future of the business. Additionally, the CFO has significant input in all of the company's financial activities such as its investments, expenses, taxes and .

What does a CFO do?

Chief financial officers are held accountable for the fiscal health of the business, and they do so by monitoring its cash balance, executing and helping to develop its long-term business strategy. They oversee teams responsible for controllership, treasury and economics, and consolidate findings from these functions to make strategic business decisions to improve the companyŌĆÖs financial performance. However, the CFO is much more than a company-wide accountant. Their crucial strategic oversight of the finance unit is often a catalyst for driving business transformation and operational changes to achieve the companyŌĆÖs corporate goals. The chief financial officerŌĆÖs responsibilities include, but are not limited to:

- Building and managing successful finance and accounting teams.

- Financial modeling, forecasting and planning to predict how the business can achieve long-term success.

- Analyzing and reporting all historical financial information and data.

- Managing the companyŌĆÖs cash flow and ensuring profit and expenses stay in balance.

- Crafting and delegating budgets.

- Working closely with investors and shareholders to raise additional capital.

- Making recommendations on mergers and acquisitions.

- Advising department heads on ways to maximize revenue and save costs.

- Overseeing the capital structure by determining the best mix of debt, equity and internal financing.

- Communicating with the C-suite and board of directors to advise them on financial risks and implications.

- Ensuring the company is compliant with federal and state tax laws.

- Assessing and designing financial systems.

Chief financial officer vs. chief revenue officer

While the chief financial officer might be the CEOŌĆÖs right-hand person when it comes to much of the companyŌĆÖs money matters, their role is not to be confused with that of the Chief Revenue Officer (CRO), a newer and more growth-focused addition to the C-suite more commonly seen in startups. The CRO of an organization ensures that the business is continually generating revenue and works to create new avenues for profit. This corporate officer may work closely with the CFO, but the CRO oversees entirely different departments, such as sales, customer success and marketing.

How to become a CFO

If you're thinking of becoming a CFO, buckle up ŌĆö it could be a long journey ahead. CFOs typically have 10 to 20 years of experience, and are expected to follow a more traditional career trajectory consisting of higher education, prestigious corporations and proven leadership experience. And if that's not challenging enough, you also have to be really good at math.

Even so, the chief financial officer is among the most prestigious and highly-paid positions in a firm, so achieving the position is definitely worth the wait. Many financial professionals begin their careers at large banks or at one of the ŌĆ£big fourŌĆØ accounting firms which include Deloitte, Ernst & Young (EY), PricewaterhouseCoopers (PwC) and Klynveld Peat Marwick Goerdeler (KPMG).

Here are some of the common job titles one might obtain before becoming a CFO:

- Financial analyst

- Accountant

- Bookkeeper

- Tax specialist

- Investment banker

- Creditor

- Financial planner

- Financial controller

- Treasurer

- Director, Vice President or Head of Finance

Skills and qualifications of a CFO

However, it takes more than just a well-mapped-out career path to become a successful CFO. There are also many necessary competencies and qualifications that one must acquire along the way to secure this role such as advanced degrees, certifications and other softer skills. The majority of people who end up in this C-level position usually possess:

- MBA in Finance, Accounting or Business Administration

- Certified public accountant (CPA) certification

- Chartered Financial Analyst (CFA) certification

- Leadership and management skills

- Technical and data analysis skills

- Communication and conflict management skills

- Strategy and corporate development skills

- In-depth knowledge of generally accepted accounting principles (GAAP) and corporate financial laws

- Significant corporate finance experience

Where does a CFO sit in an organization?

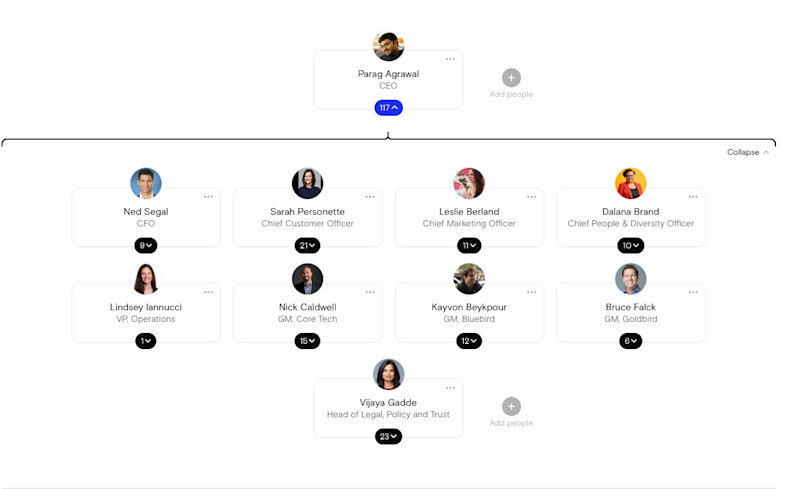

To give you a better understanding of where a chief financial officer sits in an organizational structure, view TwitterŌĆÖs public org chart. The CFO, Ned Segal, sits directly below the CEO, Parag Agrawal. Reporting to Segal are the leaders of TwitterŌĆÖs accounting, investor relations, tax and treasury, corporate development and financial planning & analysis teams.

Ready to start mapping out your own career path to the chief financial officer position? Make a (free) account and join your company to see more!

Sign up now: