How Can French Companies Successfully Sell Abroad?

Table of contents

The EU population of 448 million is an opportunity for expansion and growth for any European business, let alone French startups, but selling in the area also means handling different languages and a host of other logistical barriers.

Last week, , the government-backed initiative to promote and support French startups locally and internationally, just announced its The list features 120 companies considered to be the most promising in the country, picked based on funding, valuation, revenue, annual turnover, and growth. You may have heard of some of them due to their international media coverage over the past few years: Vestiaire Collective (platform for buying and selling second-hand clothes and handbags), BackMarket (marketplace of refurbished electronic devices and appliances from certified professional sellers), or Devialet (high-end music speakers and accessories). But many others won't sound familiar for a good reason: they're only selling in France.

While the EU’s Schengen Area makes it easy for goods and people to travel around, it removes some, but not all, of the friction caused by launching in other countries. The EU population of 448 million is an opportunity for expansion and growth for any European business, let alone French startups, but selling in the area also means handling different languages for the e-commerce website, managing warehouses and logistics partners in different countries, and dealing with local taxes. Language is another one of the many barriers companies face. When asked about their lack of language skills, 23% of French companies said it had been a major problem when selling or trying to sell to other EU countries.

How easy is it for a French startup to sell abroad then? And when is it time to consider doing so? Establishing operations abroad can be a cumbersome process, from administrative paperwork to recruiting, and it can kill a startup. Take Save, for example. After raising 15M€ ($18M) in 2015, the startup that delivered quick smartphone repair services

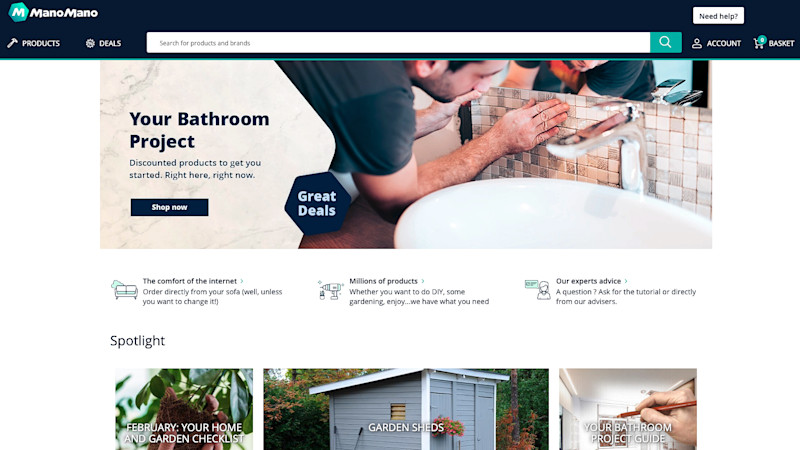

For insights into international expansion and how a French business can thrive by selling abroad, The Org spoke to Philippe de Chanville, CEO of ManoMano, a 600-employee gardening and home improvement marketplace operating throughout Europe, and Ben Hofman, who founded Atlantic Access to support businesses launching in the European Union.

Setting up a successful international roadmap for success

Founded in 2013 in France by de Chanville and Christian Raisson, ManoMano has quickly expanded since its inception. In just two years, the company expanded into Belgium, Spain, Italy, Germany and the UK. It has become a giant in its industry in less than a decade — Philippe shared that 40% of ManoMano’s record 1.2B€ ($1.45B) in business volume in 2020 was generated outside of France. How did the brand grow into being the European leader in online garden and home DIY tools?

Carefully picking the right country at the right time could be an answer.

“We are building our roadmap by looking at the market potential by country,” explained de Chanville. “The European DIY, gardening and home improvement market is giant and worth 400B€ ($484B), B2B and B2C combined, in the countries in which we are present.”

Adapting marketing and positioning

European countries also represent fragmented demands and offers. With specific cultural and industry dynamics, any business planning on going international needs to adapt its strategy and its marketing to be locally relevant.

Indeed, European neighboring countries remain very different.

“We have found that in our markets there are two different cultures and approaches to DIY and home improvement,” Phillipe explained. “In Southern Europe (Spain and Italy), consumers tend to look for “Do-It-For-Me” solutions, so it’s essential to offer them advice through our community of Manodvisors who are passionate experts in our sector, and to create a business offer for building professionals with ManoManoPro, as we did last year.”

Conversely, in countries where the culture of “Do-It-Yourself” is stronger like France, Germany, or the UK, ManoMano’s customers have access to the largest catalog in the sector, with 10 million reference pages listed on the company’s platform.

Mastering the supply chain and logistics

Any support in logistics will come in handy for whoever ships physical goods abroad. For Atlantic Access CEO Ben Hofman, finding a good 3PL (Third-Party Logistics) is probably the trickiest challenge founders have to face when it comes to shipping orders.

"There are a lot of 3PLs, and a lot of bad 3PLs," he warned. After years of experience working with young businesses, he believes a startup should not hesitate to outsource its logistics if it ends up taking too much of its time at the expense of building the business itself.

But how do you get a good 3PL if finding a good one is hard? Ben shared the two decisive questions he asks potential logistics partners in order to test them: who is in charge of their IT system, and do they use a ticketing system for customer service?

"Logistics is all about software today," Ben says. "If they outsource their IT system, it's a red warning."

Handling shipping is a worrisome task, and without a solid IT stack or an employee in charge, the partner is likely to let details fall through the cracks or lose packages.

“As far as the ticketing system is concerned, most warehouses don't answer customers' emails because there's no organization or processes to determine who is supposed to follow up,'' Ben explained.

When things get messy (and it always happens at some point), a good 3PL partner with a ticketing system will be able to follow up fast and help you figure out the situation. Without that, you're very likely to end up on your own despite working with a “partner.”

So it’s clear to see why ManoMano, a selective marketplace with a business volume above 1B€ ($1.2B), launched Mano Fulfillment, a logistics offer dedicated to its merchants. Before the product launched, its 3,600 partners would take care of the delivery of their products to the end customer. Now, ManoMano can do that for them thanks to its different warehouses set up across Europe.

Shipping from France to the UK is harder post-Brexit

Has Brexit impacted French startups’ international plans? Ben says yes, because the UK had been a favorite destination for French companies for a long time. Ben created his company to help brands launch in the EU by providing support in digital marketing, e-commerce, setting the product up on Amazon, as well as taking care of taxes.

“If a company wanted to start in an English-speaking market before getting in the U.S. they could easily go into the UK, start building the brand in English, test email campaigns, ads on Facebook, Instagram, etc,” Ben says. “Now, they lose this easy testing capacity.”

It’s especially true for those shipping goods, as every single package coming from France now needs to be cleared at customs, and end customers may receive an invoice to pay the duties to get the shipment to go through if the business didn’t take the responsibility for it.

Building the team to meet the expectations of international growth

If a founder is not from the new country or has no previous experience selling there, it can take time to figure out how the market is organized and the dynamics at stake. In that regard, ManoMano relies on teams who are native to the targeted country to identify the most relevant local partners as well as to adapt the marketing and the strategy to the expectations of the customers. Nevertheless, identifying the right acquisition channels in a new country can still be a long and tedious process. In ManoMano’s example, Philippe shared they hadn’t recognized Idealo, a German price comparison service launched in 2000, as a channel when they first arrived on the German market. Converting it into a performant channel took also a bit of time, admitted Philippe, but the company’s philosophy is to continuously test and learn to get better.

The support and network of investors can make a difference too, and not just when it comes to funding, strategy, or introduction to strategic partners. Experiencing fast-paced growth, ManoMano has assembled with the help of its French and international investors (Partech, General Atlantic, and Temasek) a team of top managers with relevant experiences. They recently appointed COO CĂ©line Vuillequez, who worked at Amazon successively as the director of the marketplace Amazon.fr and then as the director of the electronics, outdoor and indoor categories.

Setting up offices and operations abroad

Growing the business internationally may require opening offices in other countries at some point. ManoMano, which counts 650 employees across four offices as of today, set up its first international office in Barcelona in 2019. Why this country and this city in particular? In addition to Spain being their first international launch, the team had obtained strong performances on the market.

“Barcelona was a strategic choice because the city concentrates an ecosystem of international companies and attracts many talents, including in tech,” Phillipe pointed out. ManoMano even plans on doubling the size of its Barcelona office by the end of 2021 with close to 100 new jobs. Asked about opening new offices abroad in the near future, the co-CEO shared that given the global context, it’s hard to foresee new openings or what the future of work will look like.

Create your own free org chart today!

Show off your great team with a public org chart. Build a culture of recognition, get more exposure, attract new customers, and highlight existing talent to attract more great talent. Click here to get started for free today.

In this article

The ÂÜŔňÂŇÂ× helps

you hire great

candidates

Free to use – try today